Business Turnaround That Leads You Back to Profitability.

let us show you how.

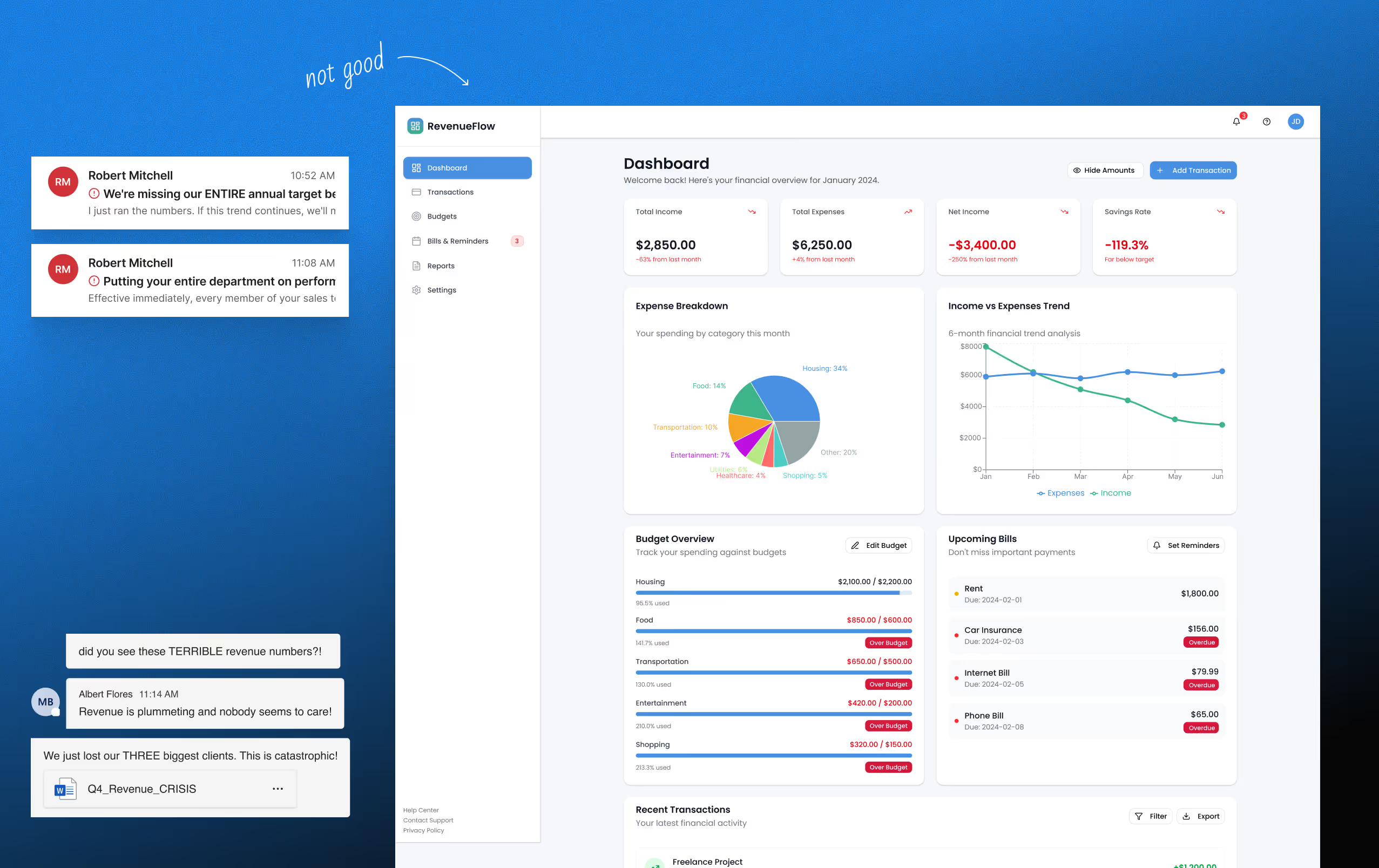

Stop Waiting for a Miracle

and Start Facing the Math

Replace Uncertainty with a Battle Plan

Diagnose & Stabilize Cash

Build 13-week rolling forecast.

Stop unnecessary ACH payments.

Protect payroll.

Create cash buffer for critical vendors.

Cut Losses & Focus Profit

Identify the 20% generating 80% of profit.

Eliminate unprofitable products, customers, and expenses.

Reallocate all resources to top performers.

Restructure Debt & Execute

Extend payment terms to match cash flow.

Then execute daily—weekly cash meetings, P&L reviews, creditor calls—until stable.

FAQ

Why can't I fix this myself?

Your bookkeeper says revenue is up. But we see you're losing $3 per unit because COGS increased 40% and nobody adjusted pricing. When you're inside the business, you can't see these blind spots. We bring objective, outside eyes with no political agenda—allowing us to spot what you've been missing.

What makes you different from other consultants?

Most executives face one crisis in their career. We manage 2-3 turnarounds per year across multiple industries. We know which creditors settle at 15% vs 40%. Which banks will extend terms. What fails in week 3 of a turnaround. This isn't theory—it's pattern recognition from hundreds of real cases.

Do you just hand me a plan and leave?

Absolutely not. We don't deliver a PDF and disappear. We attend your Monday cash meetings. Review every P&L. Negotiate with every creditor. We're there hour-by-hour until your cash position is stable. Execution is where most turnarounds fail—that's why we stay.

How long does a typical turnaround take?

Cash stabilization typically takes 4-6 weeks. We've achieved profitability in as little as 14 days for some businesses. Full turnaround including debt restructuring usually takes 3-6 months. But you'll see immediate improvements in cash visibility and decision-making within the first week.

What if my business is too far gone?

We'll tell you the truth in the first 15 minutes. If your business can't be saved, we won't take your money. But 8 out of 10 businesses we assess are salvageable—even when owners think there's no hope. The key is acting now, not waiting another month.

How much does this cost?

Every situation is different. After your free 15-minute assessment, we'll provide a clear proposal based on your specific situation and the scope of work required. Most clients find that our fees are recouped within the first month through cash flow improvements and debt settlements.

Every Second You Wait Makes This Harder

No sales pitch. Just an honest assessment of whether your business can be saved—and what it would take.